Publications

Instalment payment option for social security contributions and taxes

Social Security, Withholding Tax and VAT

(updated 14/04/2020)

This document was updated on the above date. Nevertheless, and as has proved necessary in recent days, its contents may be altered as a consequence of the publication of new legislation.

The taxpayer must elect to make phased payments over a 3 or 6-month period at both the social security and tax portals. As of today, this option to phase payments over a 3 or 6-month period is not yet available on either the Portal da Autoridade Tributária (tax office portal) or the Portal da Segurança Social Directa (social security portal).

The analysis of billing referred to below is based on the billing SAFT.

Form 22, IRC (corporation tax), Special Payment on Account and Payment on Account

Normal Deadline | Postponed Deadline | |

| Special Payment on Account | 31 March | 30 June |

| Form 22 2019 | 31 May | 31 July |

| IRC 2019 | 31 May | 31 July |

| 1st Payment on Account | 31 July | 31 August |

- The due dates for the 2nd and 3rd payments on account have not yet been confirmed.

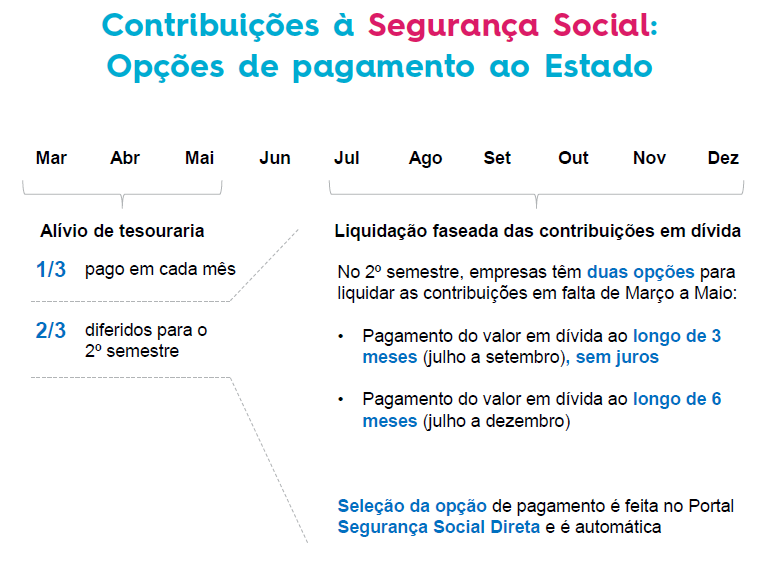

Social Security Contributions

- Companies may pay their social security contributions in instalments over 3 or 6 months. That is, they may defer the 23.75% charge (paid by the business).

- The 11% (employee) contributions may not be paid in instalments.

- If one instalment payment is missed, the company will lose its entitlement to pay its dues in instalments.

| Who can benefit? |

|

| Which payments may be made in instalments? |

|

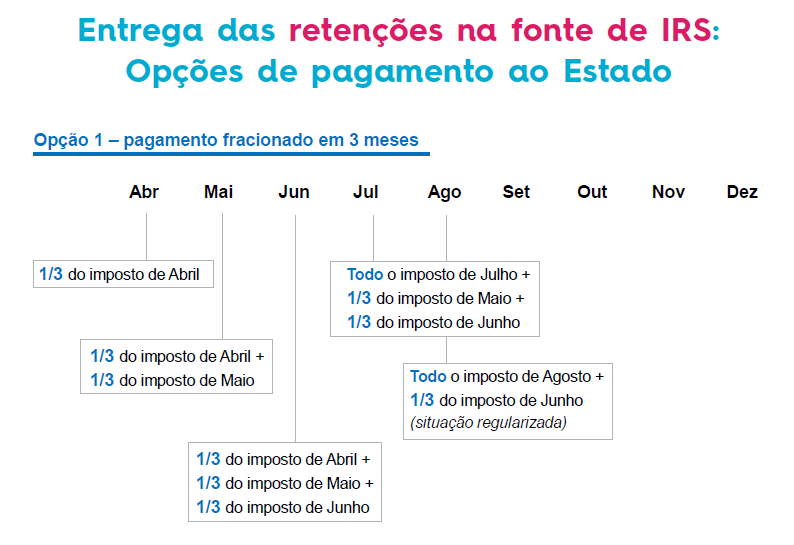

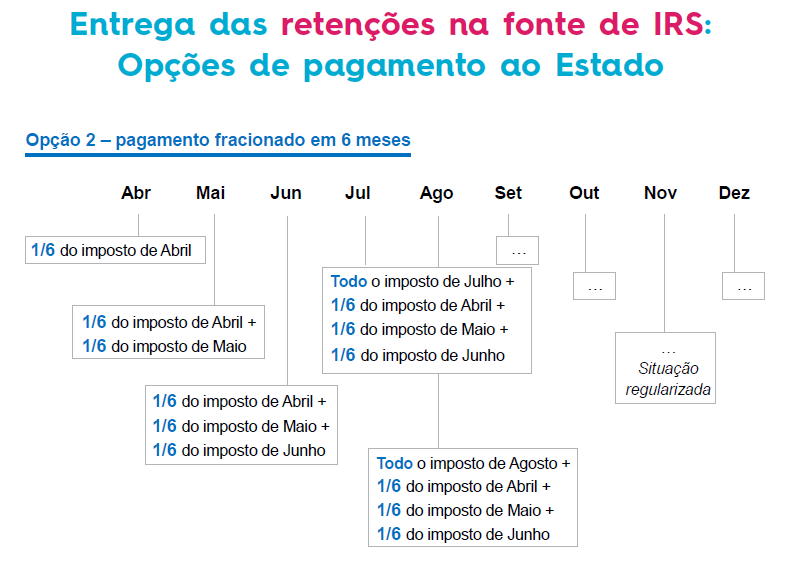

IRS (income tax) and IRC (corporation tax) Withholdings

| Who can benefit? |

|

| Which payments may be made in instalments? |

|

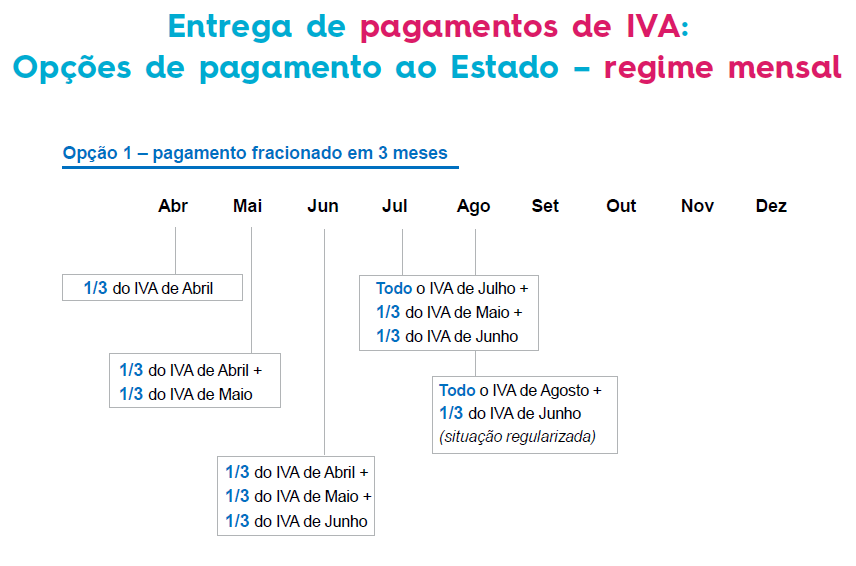

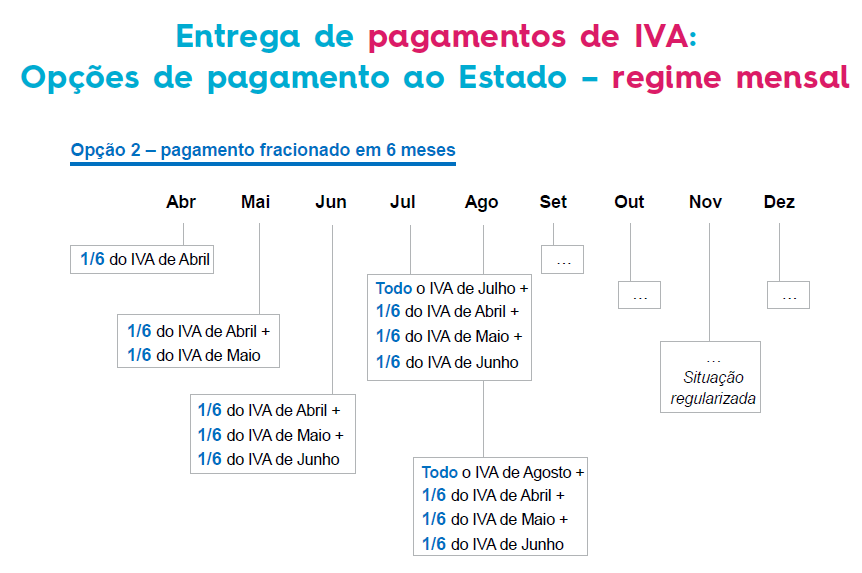

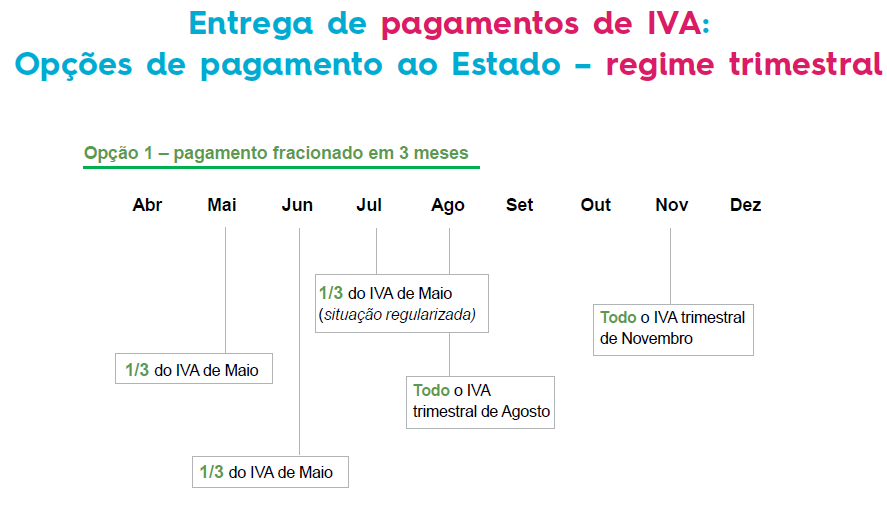

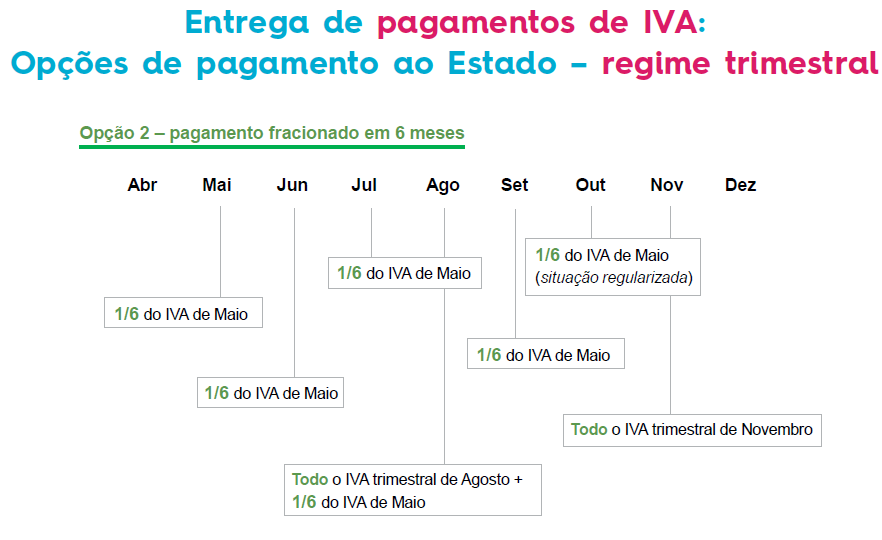

VAT

| Who can benefit? |

|

| Which payments may be made in instalments? |

|

Extraordinary Support for the Safeguarding of Employment Contracts

Extraordinary Support for Businesses

Simplified Lay-Off

(updated 14/04/2020)

This document was updated on the above date. Nevertheless, and as has proved necessary in recent days, its contents may be altered as a consequence of the publication of new legislation.

- Business Crisis – Circumstances

- Full or partial shutdown of the establishment or premises, as decreed by the government under the current State of Emergency.

- Interruption of the supply chain or the cancellation or orders.

- Sharp fall, of at least 40%, in billing.

The sharp 40% fall in billing is measured over the 30 days before the lay-off request is filed with Social Security. This is then compared with the average for the two months preceding this (30-day) period or on a year-on-year basis (30 days from the previous year).

Thus, if the company files a lay-off request with Social Security on 1 April, the comparison will be between the period 01/03/2020 to 31/03/2020 and either the months of January and February 2020 or 01/03/2019 to 31/03/2019.

Depending on the specific type of business, it is likely that, by mid-April, the company will be able to calculate and show a 40% plus fall in billing.

For companies that are less than 12 months old, billing is averaged over the entire time the company has been in business.

- Support access requirements

The business must be in full compliance with its tax (AT) and Social Security obligations or have an agreed payment plan in effect.

There must be no termination of employment contracts through job elimination or collective redundancies during the lay-off period or in the 60 days subsequent to this.

Contracts that have come to term (and are not renewed), those for which the employee has requested termination or those that are in their trial period are not included in this analysis.

- Means of proof

Employer statement to the workforce informing them of the start of the Simplified Lay-Off and its expected duration.

Filing of an application with Social Security, with a list of the employees covered by the lay-off (Form RC 3056/1).

Statement from the company’s certified accountant, where the lay-off is the result of a sharp fall of at least 40% in billing.

- The billing SAFT will serve as proof of the falloff in billing.

- Support access procedures

The employer will inform the workforce, in writing, that it is going to apply for the extraordinary support provided through the simplified lay-off scheme. It will indicate how long the measure is expected to last. The lay-off may be extended on a monthly basis, up to a maximum of 3 months.

- This statement must also indicate that gross salaries will be cut to 2/3.

The means of proof and the list of employees covered, with their NISS (social security numbers), must be uploaded to the social security portal (Segurança Social Directa).

The company’s bank account number (NIB) must be updated on the same portal (Segurança Social Directa).

- Payment to employees and the level of support granted

The lay-off benefit (2/3 salary) applies to both employees and managers (with employment contracts). It does not apply to managing partners.

Social Security will confirm or not whether those managers who have employment contracts are deemed to be employees of the company.

Each employee is entitled to 2/3 of their gross monthly salary. The minimum amount payable is €635 and the maximum is €1,905.

The employer will pay 30% of this amount (2/3 of the salary) and Social Security will pay 70% of the same amount.

The company will pay each employee 2/3 of their monthly salary. Social Security will reimburse the company the said 70% after this payment has been made.

Social Security will transfer the amount in question to the company’s bank account on the 28th of each month.

The 11% social security contribution paid by the employee will still be payable. The company’s 23.75% social security contribution will be temporarily waived.

This waiver of the company’s 23.75% social security contribution applies to employees, managers (with employment contracts) and managing partners.

For those companies in which 2 salaries are paid (1 employee and 1 manager), the employee may benefit from the cut to 2/3 salary and the 70% Social Security support, as well as the temporary waiver of the company 23.75% social security contributions. The manager may only benefit from the temporary waiver of the company 23.75% social security contributions.

Those companies at which the only paid salary is that of the managing partner are not entitled to make use of the lay-off support mechanism (or of the 70% Social Security support or of the waiver of the company 23.75% contribution).

If the Company maintains the job after the lay-off period, it will receive an additional support of € 635 for each worker.

- Examples:

100% of worker time at home | |||||||

Gross Salary | 2/3 Gross Salary | Gross Salary received by the worker | Social Security benefit 70% | Cost suported by the company 30% | Aditional support to keep the job | Socal Security reduction | Total Benefits |

635,00 | 423,33 | 635,00 | 444,50 | 190,50 | 635,00 | 150,81 | 1.230,31 |

1.100,00 | 733,33 | 733,33 | 513,33 | 220,00 | 635,00 | 174,17 | 1.322,50 |

1.000,00 | 666,67 | 666,67 | 466,67 | 200,00 | 635,00 | 158,33 | 1.260,00 |

2.500,00 | 1.666,67 | 1.666,67 | 1.166,67 | 500,00 | 635,00 | 395,83 | 2.197,50 |

3.500,00 | 2.333,33 | 1.905,00 | 1.333,50 | 571,50 | 635,00 | 452,44 | 2.420,94 |

- Duration of the support

The support provided to companies that apply to the simplified lay-off scheme has an initial duration of one month. Under exceptional circumstances, this may be extended to a maximum of three months.

For the monthly renewal of the simplified lay-off scheme, the company will need to update and resubmit the information indicated in “Support access procedures”.

- Managing Partners

The regulation for the support provided to Managing partners was published on 06/04/2020. This requires further regulation and clarification before it can be applied. What we know at the current time is that this will be similar to the support provided to the self-employed.

- Self-Employed Workers

The self-employed may be covered by the extraordinary support for the falloff in business activity, provided that they have not billed any amounts in a given month and that they are only covered by the self-employment scheme. In other words, they cannot also be employees of another business.

This mechanism may be renewed monthly, up to a maximum of six months.

Self-employed workers registered under the simplified accounting scheme must have a certified accountant.

In order to access this support mechanism, they must also have paid social security contributions for at least three consecutive months in the last twelve months.

The amount of support is calculated on the basis of these social security contributions, with a limit of 1 IAS (social support index – currently €438.81). At the current time, we have no information on the method that will be used to calculate the support.

While the current economic situation lasts, the payment of contributions by self-employed workers is deferred. That is, monthly payments are suspended but they will have to be paid, once the support has ended, in the twelve months following the termination of support.

- Additional considerations

These support mechanisms are not automatic and will be subject to scrutiny by Social Security.

- Due to the complexity of this regulation, we are awaiting further clarification from Social Security on certain specific issues.

The simplified lay-off cannot be applied to companies at which the only person being paid is the managing partner. However, we are aware that the government is considering another support mechanism for such situations.